(Bloomberg) — Stock traders took some risk off the table ahead of the Federal Reserve decision, with a trio of tech heavyweights kicking off the megacap earnings season just days after DeepSeek rattled markets.

The S&P 500 fell ahead of results from Meta Platforms Inc., Microsoft Corp. and Tesla Inc. A gauge of the “Magnificent Seven” megacaps dropped 1%, with Nvidia Corp. coming under renewed pressure. Apple Inc. slipped after an analyst downgrade. ASML Holding NV surged after booking orders worth twice as much as analysts expected. Treasuries and the dollar barely budged.

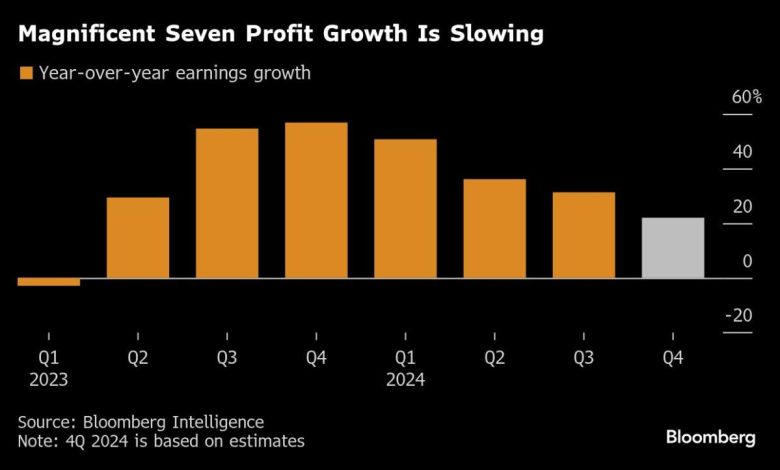

While profits from the Magnificent Seven behemoths are still rising — and far outpacing the rest of the market — growth is projected to come in at the slowest pace in almost two years. Yes, it’s also Fed day. And officials are widely expected to pause their rate cuts, with traders looking for any signal from Chair Jerome Powell on which way inflation is going.

“A hawkish outcome that sends yields higher could cause a painful selloff in equities,” said Tom Essaye at The Sevens Report. “Today is also the first day of big tech earnings. Expectations are already optimistic for 2025 so any disappointment could pressure stocks in after-hours trading regardless of the initial reaction to the Fed announcement.”

Those briefings have headier stakes now, thanks to DeepSeek. The US tech behemoths are under increasing scrutiny for their spending on artificial intelligence and the meager returns they’re generating from the technology, as virtually all of Wall Street tries to understand how the Chinese AI upstart managed, seemingly overnight, to catch up at what appears to be a sliver of the cost.

Speaking of which, Microsoft Corp. and OpenAI are investigating whether data output from OpenAI’s technology was obtained in an unauthorized manner by a group linked to DeepSeek, according to people familiar with the matter. The Chinese startup is being quizzed by Ireland’s privacy watchdog amid concerns over the way it’s processing data related to citizens in the nation.

The S&P 500 fell 0.3%. The Nasdaq 100 dropped 0.3%. The Dow Jones Industrial Average rose 0.1%.

The yield on 10-year Treasuries as little changed at 4.53%. The Bloomberg Dollar Spot Index wavered. The loonie remained lower after the Bank of Canada cut rates, but dropped guidance on any further adjustments to borrowing costs.

The recent volatility among tech giants has been particularly worrisome for Wall Street, as the S&P 500’s leadership hasn’t been this concentrated in more than 20 years. Data shows that less than one-third of index members were able to outperform the S&P 500 during the past two years, as Bank of America Corp. strategist Michael Hartnett has called out.

That resembles the run-up to the dot-com bubble at the end of the 1990s, when a similarly slim cadre of stocks were beating the benchmark. The risks for markets from such concentration have been on display this week, as the DeepSeek jolt wiped out half a trillion dollars of Nvidia’s market value.

“The DeepSeek correction in tech stocks has not changed the overall concentration problem in the S&P 500,” said Torsten Slok at Apollo. “Investors in the S&P 500 continue to be dramatically over-exposed to the tech sector.”

The tech-led selloff in US equities at the start of this week was just a blip, given the positive outlook for the economy, according to Goldman Sachs Group Inc. strategists.

That slump isn’t a harbinger of a sustained decline in stocks, the Goldman team led by Peter Oppenheimer wrote in a note.

“Most bear markets are triggered by expectations of falling profits driven by fears of recession,” which has a low probability of occurring in the next 12 months, the strategists said.

“The DeepSeek selloff is an example of an unexpected surprise that cut right through the market’s crown jewels, the Magnificent Seven,” said David Laut at Abound Financial. “While the markets have staged a nice rebound since Monday’s declines, a larger correction doesn’t happen without the crown jewels being stolen or at least threatened, and that’s exactly what happened on Monday. A larger correction in AI is still possible.”

Laut also noted that this week’s stock market volatility is a window of what to expect this year.

“We would not be surprised to see additional 2%+ upside and downside daily moves in the major indices, largely because it’s been a few years since we’ve seen a correction of more than 10% and we are overdue for one,” he added.

And just ahead of the Fed decision, Laut says the big question for the Fed is if rate cuts are even on the table at all for 2025, as it’s difficult to argue that rate cuts are needed when the labor market is strong and inflation is still sticky.

A survey conducted by 22V Research shows 67% of respondents expect the reaction to the Fed Wednesday to be “mixed/negligible,” 21% said “risk-off” and 12% “risk-on.”

“The Fed meeting is not likely to be as impactful as any other meeting over the past few years, but a dovish surprise would still suggest some upside to risk assets,” said Dennis DeBusschere at 22V.

A dovish or risk-on Fed meeting would be a tailwind for early cyclicals (tech, discretionary, communications), growth and momentum factors on the day, he noted, adding that such reaction is likely to come with lower yields.

Countdown to Fed:

It is hard to think of a time when one was less anticipated than this one. No change in rates is not just expected, it’s as near a sure-thing as it gets. As for communication, it is always conditional and today could be more conditional than usual. There are simply too many unknowns that may affect the inflation, growth, and labor market data guiding Fed policy.

All that said, we do expect Jay Powell will frame upcoming policy decisions in a way that makes it clear the Fed still intends to ease, but easing will depend on further progress toward the Fed’s 2% inflation goal.

The market reaction hinges not on whether the statement is more hawkish than December’s — when the Fed chose to cut rates, after all — but on whether the hawkish shift is more or less than expected. In this case, more hawkish is universally expected, so neither statement nor presser should cause the markets to move much unless Powell steps well out of his comfort zone.

The Fed probably won’t issue a “dovish” tone based on the lower-than-expected inflation data for December. Rather, the recent flurry of universal tariff-talk coming just before the Fed meets means that sufficient uncertainty over the path of inflation persists, and an endorsement of the ‘dots” two rate cuts won’t happen. Traders may see that as “hawkish.”

Simply put, the strong U.S. fundamental story of strong growth, elevated inflation, and a more hawkish Fed continues to favor higher U.S. yields and a stronger dollar.

We see some risks that the Fed’s decision is not unanimous after Governor Waller went full dove ahead of the media blackout. However, we believe he is in the clear minority, with most other officials preferring to keep policy on hold until the economic outlook becomes clearer.

We expect Powell to emphasize again that the FOMC can be “more cautious as we consider further adjustments to our policy rate.” Of note, the next cut is now fully priced in for June and a second hike in December is now nearly priced in. Both are slightly more dovish than previous pricing but it will all come down to the data.

It is Fed day and everyone knows the Fed will not do anything to rates today. We think the majority of the Fed participants are scared about inflation and refuse to look forward.

While Powell is not the only Dove on the Fed, Waller looks like another, we think the Fed statement will be somewhat Hawkish. While they won’t take March off the table, they will try to get the markets to back off for a first half rate cut. The unknown is how a Dovish Powell will spin it.

Corporate Highlights:

-

Trump Media and Technology Group Corp. launched a financial-services and fintech brand dubbed Truth.Fi, with a focus on crypto and customized exchange-traded funds.

-

Alibaba Group Holding Ltd. published benchmark scores and touted what it called world-leading performance with its new artificial intelligence model release.

-

Apple Inc. has been secretly working with SpaceX and T-Mobile US Inc. to add support for the Starlink network in its latest iPhone software, providing an alternative to the company’s in-house satellite-communication service.

-

Starbucks Corp. reported better-than-expected quarterly results, luring back lapsed customers with coffee-focused ads and by removing extra charges for nondairy milk.

-

T-Mobile US Inc. reported fourth-quarter results that beat analysts’ projections, benefiting from continued growth in wireless subscribers and home internet customers.

-

Cigna Group plans to limit patients’ out-of-pocket expenses for medications as the insurer faces pressure from Washington over its role in prescription costs.

-

Bankrupt Spirit Airlines Inc. rejected a new acquisition offer from the parent of Frontier Airlines but said it remains open to a long-discussed combination of the budget carriers.

Key events this week:

-

Eurozone ECB rate decision, consumer confidence, unemployment, GDP, Thursday

-

US GDP, jobless claims, Thursday

-

Apple, Deutsche Bank earnings, Thursday

-

US personal income & spending, PCE inflation, employment cost index, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.3% as of 11 a.m. New York time

-

The Nasdaq 100 fell 0.3%

-

The Dow Jones Industrial Average rose 0.1%

-

The Stoxx Europe 600 rose 0.6%

-

The MSCI World Index was little changed

-

Bloomberg Magnificent 7 Total Return Index fell 1%

-

The Russell 2000 Index rose 0.1%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro fell 0.1% to $1.0418

-

The British pound was little changed at $1.2436

-

The Japanese yen rose 0.3% to 155.10 per dollar

Cryptocurrencies

-

Bitcoin rose 1.7% to $102,003.23

-

Ether rose 1.6% to $3,100.77

Bonds

-

The yield on 10-year Treasuries was little changed at 4.53%

-

Germany’s 10-year yield was little changed at 2.57%

-

Britain’s 10-year yield declined two basis points to 4.60%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Margaryta Kirakosian, Sujata Rao and Aya Wagatsuma.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.