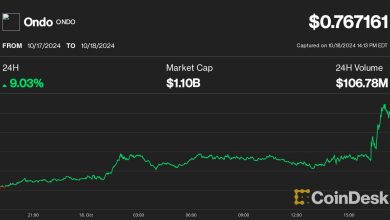

Singapore’s crypto crackdown on unlicensed exchanges could drive liquidity to Hong Kong

Hong Kong could benefit from Singapore’s recent move to oust unlicensed cryptocurrency companies, according to analysts, potentially leading to a significant injection of liquidity.

On May 30, the Monetary Authority of Singapore instructed cryptocurrency firms incorporated in the city and offering services abroad to acquire a licence or leave the country. Singapore’s central bank subsequently set a June 30 deadline for crypto service providers in the city state to stop offering digital token services to overseas markets.

“These moves are intimately connected, forming a strategic blueprint that could redefine Hong Kong’s role in the global virtual asset ecosystem,” Chu said. “This is likely to attract quality projects looking for a compliant, liquid, and globally connected base.”

He added that Singapore’s crackdown was part of a broader trend to regulate the industry and weed out bad actors. Thailand last month moved to ban five crypto exchanges, including major operators OKX and Bybit, while Dubai’s Virtual Asset Regulatory Authority recently updated its rules to strengthen investor protections.

“In the current climate, regulatory actions across Asia are best understood as a region-wide game of ‘FATF musical chairs’, and nobody wants to be left standing when the music stops,” Chu said, using the abbreviation for financial action task force.