Shaq’s $1.8 Million FTX Settlement Signals The Fall Of Celebrity Crypto Hype

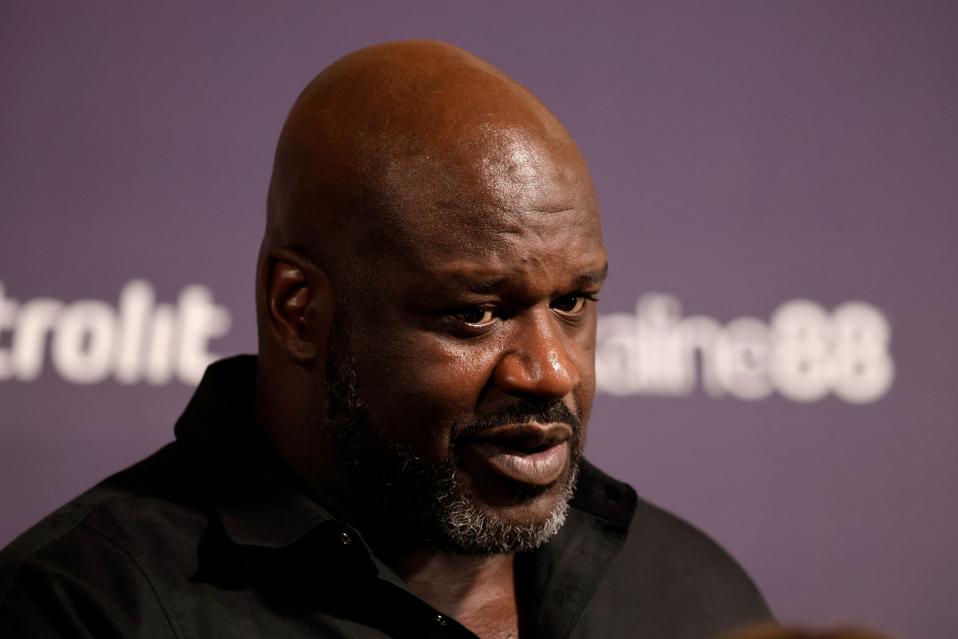

LOS ANGELES, CALIFORNIA – FEBRUARY 11: Shaquille O’Neal attends Shaq’s Fun House presented by FTX at … More

Shaquille O’Neal may have dominated on the basketball court, but his off-court moves in crypto haven’t aged quite as gracefully. The NBA Hall of Famer recently agreed to a $1.8 million settlement in a class action lawsuit over his role promoting FTX, the now-defunct cryptocurrency exchange. O’Neal, along with high-profile celebrities including Steph Curry, Tom Brady and others, were caught in the crosshairs when the $32 billion company collapsed, according to Bloomberg. As celebrity-backed crypto ventures fall under sharper scrutiny, the FTX fallout has become a cautionary tale with deep cultural implications, especially for vulnerable communities often targeted by influencer marketing.

The Breakdown You Need To Know:

CultureBanx noted that celebrity crypto endorsements have played a major role in legitimizing platforms that lacked regulation and transparency. In communities where trust in traditional financial systems has historically been low, figures like O’Neal, who enjoy cross-generational and cultural credibility, carry enormous influence. A Pew Research study, found that Black Americans are more likely than white Americans to have invested in or traded cryptocurrency, making the stakes even higher when things go sideways.

The class action lawsuit accused O’Neal and other celebrities of promoting unregistered securities and failing to disclose compensation received for endorsements, violations that the SEC has aggressively targeted. He denied wrongdoing but agreed to pay $750,000 in cash and $1.05 million in FTX equity to settle the lawsuit. While that amount may not dent Shaq’s net worth, it does send a signal that celebrity endorsements of crypto are not immune from legal accountability.

Crypto Marketing Blitz:

FTX built its empire by aggressively pursuing celebrity endorsements. These stars brought mainstream credibility to its platform before its eventual collapse. Here are a few of the celebrity partnerships that stood at the heart of FTX’s strategy:

- Tom Brady and Gisele Bündchen got equity stakes in FTX worth approximately $48 million

- Stephen Curry starred in commercials

- Shaquille O’Neal backed the platform on social media

- David Ortiz pushed viewers to join the “FTX list”

- Trevor Lawrence, Naomi Osaka, and Larry David joined as brand ambassadors

Celebrity-less Credibility:

Needless to say that with this type of celebrity packed roster, FTX’s dramatic fall shocked the crypto world. The company, once worth $32 billion, ranked as the world’s third-largest cryptocurrency exchange. In the Fall of 2022, people learned that founder Sam Bankman-Fried had stolen billions in customer funds.

This affected more than a million people. U.S. courts sentenced Bankman-Fried to 25 years in prison in March 2024. The settlement looks big on paper, but court documents show each person in the class action might get less than $2 after legal fees.

Influence and Investment:

FTX’s rise was fueled in part by a culture of hype, where celebrities became ambassadors of trust. A Bloomberg report highlighted how FTX strategically built a “cool factor” through celebrity deals, from NBA arena naming rights to Super Bowl commercials.

But while these figures were paid millions, many retail investors, particularly from multicultural backgrounds were left holding the bag. The lack of clarity about what celebrities were paid, and what they actually knew about the companies they endorsed, underscores a troubling power imbalance.

It’s important to note that Shaq’s settlement amount is bigger than what he got paid for promoting FTX. This extra refund shows how serious the legal consequences are for celebrity promoters and proves how strict securities laws can be.

What’s Next:

The SEC’s enforcement started before the FTX collapse. Kim Kardashian settled with the SEC for $1.26 million after she failed to disclose her $250,000 payment for promoting EthereumMax tokens. Floyd Mayweather paid over $600,000 to settle charges about undisclosed promotion of initial coin offerings. DJ Khaled had to pay more than $150,000 because he didn’t disclose Centra Tech’s $50,000 payment.

At this point the days of no-questions-asked endorsements may be numbered, especially with increasing calls for regulation from lawmakers and consumer watchdogs. For diverse investors, the moment is ripe for a reset, one that centers financial literacy, transparency, and community-centered growth over celebrity hype.