‘Trump’s Going To Take The Fed Over’—Bitcoin And Crypto Brace For ‘Serious’ Price Shock

Donald Trump’s war of words against the Federal Reserve and its chair Jerome Powell have shocked bitcoin, crypto and stock markets this year (with Trump now armed with a surprise, secret weapon).

Sign up now for CryptoCodex—A free crypto newsletter that will get you ahead of the market

The bitcoin price has surged alongside gold to an all-time high last month, pushing the combined crypto market to over $4 trillion as the crypto “floodgates are starting to open.”

Now, as Tesla billionaire Elon Musk issues a stark, $37 trillion warning, a close ally of Trump has predicted the president will “take the Fed over,” something that could up-end the global financial order and cause chaos for the bitcoin price, crypto and stock markets.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

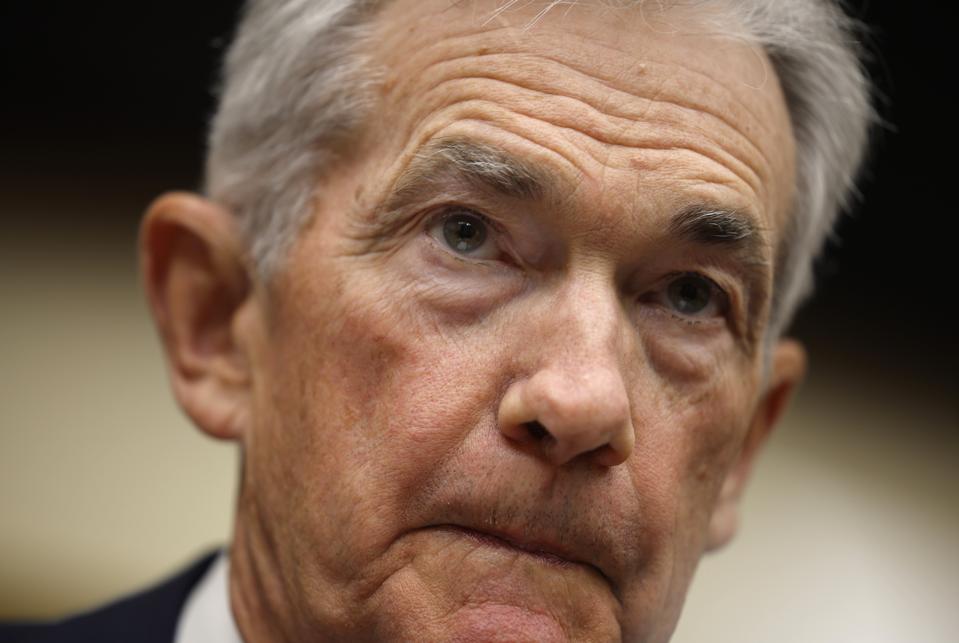

Federal Reserve chair Jerome Powell has been sharply criticized by president Donald Trump—playing havoc with the bitcoin price, crypto and stock markets.

Getty Images

“Trump was furious at Powell in the first term for jacking up [interest] rates for no particular reason,” Larry Kudlow, a close ally of Trump who was a top adviser in the White House during the president’s first term, told the New York Post.

“It’s sort of a sad tale. If it weren’t such serious business, it reads comedically to some extent; people yelling at each other. But look, the bottom line is: President Trump’s going to take the Fed over, as he should.”

The row between Trump and the Fed has been brewing for years, with accusations of political bias beginning when Powell incorrectly called post-Covid lockdown inflation “transitory,” holding back from increasing interest rates in response to rising prices.

The battle was turbo-charged when Powell surprised markets with a 50 basis point inflation hike in September last year, seen by some as a gift to Trump’s Democratic Party election rival Kamala Harris.

Earlier this year, Trump raised the possibility he could remove Powell before his term is up next year, spooking markets that fear the end of Federal Reserve political independence. However, the odds on Trump “removing” Powell on the crypto-powered Polymarket prediction platform have dropped to around 5% from a peak of 20% in July.

Since then, Trump has tried to remove Fed governor Lisa Cook and installed Stephen Miran, chair of the Council of Economic Advisers (CEA) and a bitcoin supporter, as a temporary Fed governor.

Sign up now for CryptoCodex—A free crypto newsletter that will get you ahead of the market

The bitcoin price has rocketed higher this year, soaring as president Donald Trump creates a Federal Reserve nightmare for chair Jerome Powell.

Forbes Digital Assets

“What investors appear to be overlooking is president Trump’s continued meddling in the [Fed’s] affairs, thereby threatening its independence. This could end up being a far more serious issue,” David Morrison, senior market analyst at Trade Nation, said in emailed comments.

This week, the Fed is widely expected to cut interest rates, responding to a slowing labor market that’s outweighed the risk of inflationary price pressures.

Many of the most bullish bitcoin traders and investors have predicted the bitcoin price will climb at a faster rate when the Fed does begin to lower interest rates, something that encourages cash to flow more quickly through the economy.

The bitcoin price and wider crypto market has surged over the last week, with bitcoin climbing 5% as traders feel emboldened by what’s expected to be a dovish Fed pivot.