Crypto Crash: Could Buying Ethereum on the Dip Make You a Millionaire?

Investors who believe in Ethereum’s fundamentals could use the recent turmoil in the crypto markets as a buying opportunity.

The total value of all cryptocurrencies in circulation just fell to $2.3 trillion, which is the lowest level since 2024, and practically every coin and token has been swept up in the latest sell-off. Ether (ETH 0.23%), which is the native cryptocurrency in the Ethereum network, is down by a whopping 57% from its 2025 peak as I write this.

Ethereum is the world’s leading platform for creating decentralized applications, which are popular in areas like financial services and gaming. Every time someone uses an Ethereum-based app, they incur a fee payable in Ether, which creates demand for the cryptocurrency. That means as long as the network continues to expand, Ether should theoretically rise in value.

Ethereum’s fundamental story hasn’t changed, so could buying Ether during the broader crypto sell-off help investors join the millionaire’s club?

Image source: Getty Images.

The top destination for decentralized apps

Decentralized applications are governed by slivers of code called smart contracts, which live on the Ethereum blockchain. These contracts lay out the rules for each app, and they usually can’t be changed, which ensures no person or company can seize control over the app’s functions. The idea is to take humans out of the loop entirely by creating a system where every user is treated equally.

The Ethereum network itself is also decentralized, because its blockchain system of record is hosted on thousands of nodes (computers) all over the world, rather than in one centralized data center. Therefore, even if a few of these nodes — which can be operated by almost anybody — are knocked offline, it won’t compromise the entire network. This is how Ethereum has boasted a perfect 100% uptime over the last decade.

Developers have created thousands of decentralized apps on Ethereum so far. Uniswap is one of the most popular. It’s a decentralized exchange where customers can trade their cryptocurrencies for other cryptocurrencies, and it uses smart contracts to set prices and execute transactions. Plus, it doesn’t require an account, because it allows users to simply connect their existing crypto wallets directly to the exchange.

Today’s Change

(-0.23%) $-4.54

Current Price

$1971.45

Key Data Points

Market Cap

$238B

Day’s Range

$1946.07 – $2005.26

52wk Range

$1398.62 – $4946.05

Volume

19B

Therefore, Uniswap is far more convenient to use than a centralized exchange like Coinbase, for example, which is very tightly regulated. Not only do users have to make an account with Coinbase, but they also face restrictions regarding where and how they transfer money, because the exchange must comply with strict anti-money laundering rules.

Whenever someone uses a decentralized app like Uniswap, they activate smart contracts that trigger fees payable in Ether. This creates a constant stream of demand for Ether, which sets it apart from most other cryptocurrencies that are often at the mercy of speculative investors.

Could Ethereum be a millionaire-maker from here?

Ethereum has a growing amount of support on Wall Street. Tom Lee from Fundstrat Global Advisors believes the ecosystem could transform industries like financial services, propelling Ether to $62,000 per coin by 2035. Based on the current circulating supply of 120.7 million coins, that would give Ether a market capitalization of $7.5 trillion.

It’s hard to predict how successful decentralized applications will be in the future, but Lee’s target would make Ether more valuable than the world’s largest company, Nvidia, which is currently worth $4.5 trillion. I’m not sure if that’s realistic, especially with competition ramping up in this space.

The Solana network, for example, was designed to address some of Ethereum’s limitations, boasting faster and cheaper transactions, especially at scale. This could be very disruptive for Ethereum if decentralized app adoption continues to grow.

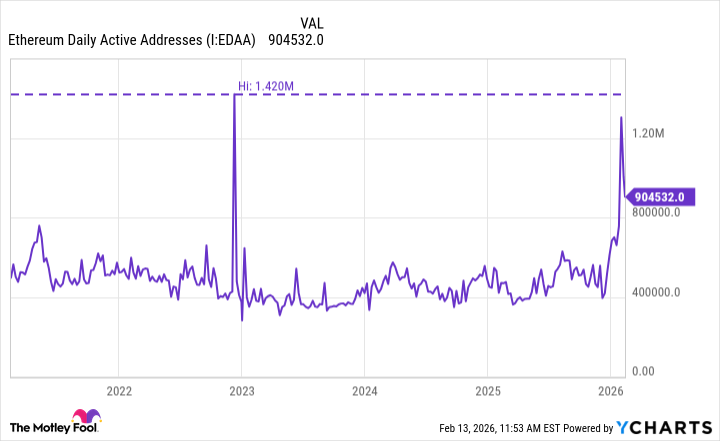

On the plus side, the number of Ethereum daily active addresses, which is a measure of network activity, has more than doubled over the last few months. Although the network still hasn’t surpassed its 2022 peak of 1.4 million daily active addresses, an uptick in activity is always a good sign for Ether.

Ethereum Daily Active Addresses data by YCharts

If Lee’s target proves to be right, an investor who parks around $33,000 in Ether today could be a millionaire within a decade. However, a more realistic target might be Ether’s 2025 record high of $4,830, which would be a 135% gain from its current price. It would take a much larger investment of around $425,000 to become a millionaire from a return like that, but I’d say the odds are much higher.

With that said, no matter how much money I had, I would always be cautious investing such a big chunk of change in a volatile asset like Ether.