Complaint Accuses Todd Blanche of “Blatant” Crypto Conflict — ProPublica

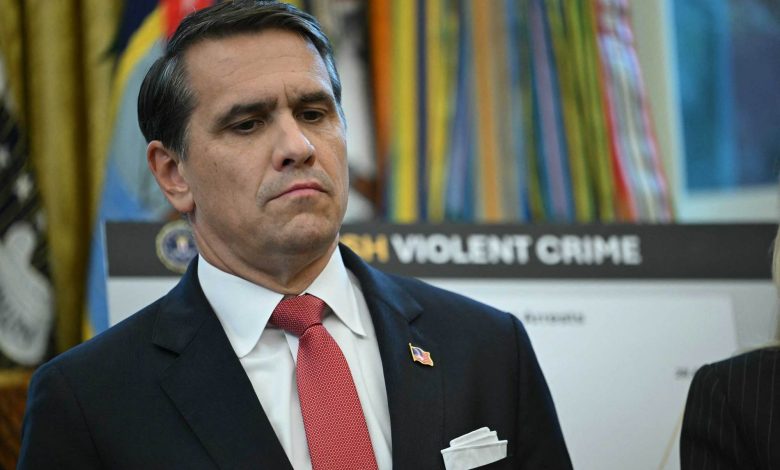

An ethics watchdog group filed a complaint Thursday seeking an investigation into whether President Donald Trump’s criminal defense attorney — now the No. 2 at the Justice Department — broke federal conflict-of-interest law when he issued a new prosecution policy that benefits the cryptocurrency industry.

The complaint comes after a ProPublica investigation revealed last month that Todd Blanche owned at least $159,000 worth of crypto-related assets when he ordered an end to investigations into crypto companies, dealers and exchanges launched during President Joe Biden’s term. Blanche, the deputy attorney general, issued the order in an April memo in which he also eliminated an enforcement team dedicated to looking for crypto-related fraud and money-laundering schemes.

Blanche had previously signed an ethics agreement promising to dump his cryptocurrency within 90 days of his confirmation and not to participate in any matter that could have a “direct and predictable effect on my financial interests in the virtual currency” until his bitcoin and other crypto-related products were sold.

Later ethics filings show Blanche divested from the investments more than a month after he issued the memo. Even when he did ultimately get rid of his crypto interests, his ethics records show he did so by transferring them to his adult children and a grandchild, a move ethics experts said is technically legal but at odds with the spirit and intent of the law.

In its complaint this week, the Campaign Legal Center asked the Justice Department’s acting inspector general to launch an investigation. The complaint alleged that the evidence suggests that Blanche “blatantly and improperly influenced DOJ’s digital asset prosecution guidelines while standing to financially benefit.”

“The public has a right to know that decisions are being made in the public’s best interest and not to benefit a government employee’s financial interests,” Kedric Payne, the organization’s general counsel and senior director of ethics, wrote in the complaint. The inspector general’s office “should investigate and determine whether a criminal violation occurred.”

The Campaign Legal Center is a nonpartisan government watchdog group dedicated to addressing challenges facing democracy in the U.S. Its trustees and staff include Democrats and Republicans, including Trevor Potter, a Republican former chair of the Federal Election Commission, who serves as president of its Board of Trustees.

Under the federal conflicts-of-interest statute, government officials are forbidden from taking part in a “particular matter” that can financially benefit them or their immediate family unless they have a special waiver from the government. The penalties range from up to one year in jail or a civil fine of up to $50,000 all the way to as much as five years in prison if someone willfully violates the law.

In the complaint, Payne alleged that Blanche’s orders violated the law because they benefited the industry broadly, including his own investments. He estimated that Blanche’s bitcoin alone rose by 34%, to $105,881.53, between when he issued the memo and when he divested. At the time he issued the memo, Blanche also held investments in several other cryptocurrencies, including Solana and Ethereum, and stock holdings in Coinbase.

Payne said “strong evidence” of wrongdoing triggered his group’s request for an investigation.

“I can’t think of another situation where I’ve seen someone sign an ethics agreement and then take an action that doesn’t comply with the agreement and you can clearly verify that they did it,” said Payne, a former deputy general counsel at the Office of Congressional Ethics and the U.S. Energy Department.

The Justice Department did not immediately respond to requests for comment.

Blanche, a former federal prosecutor for the Southern District of New York, was Trump’s lead attorney in the Manhattan trial that resulted in his being convicted of 34 felonies stemming from a hush-money payment to a porn actress, Stormy Daniels. Blanche also defended Trump against criminal charges accusing him of conspiring to subvert the 2020 election and retaining highly classified documents. (Those two cases were dropped after Trump was reelected president.)

Since gaining Senate confirmation on March 5, Blanche has helped lead a remaking of the Department of Justice and made headlines in other ways. As news of Trump’s ties to the disgraced financier Jeffrey Epstein gained momentum last year, Blanche personally interviewed Ghislaine Maxwell, Epstein’s longtime confidante now serving a 20-year prison sentence for helping him sexually abuse underage girls.

In his April 7 memo titled “Ending Regulation by Prosecution,” Blanche condemned the Biden Justice Department’s tough approach toward crypto as “a reckless strategy of regulation by prosecution, which was ill conceived and poorly executed.” The memo disbanded the agency’s National Cryptocurrency Enforcement Team, which had won several high-profile crypto-related convictions. Blanche said the agency would instead target only the terrorists and drug traffickers who illicitly used crypto, not the platforms that hosted them.

“The digital assets industry is critical to the Nation’s economic development and innovation,” Blanche wrote. “President Trump has also made clear that ‘[w]e are going to end the regulatory weaponization against digital assets.’”

The market reacted favorably; crypto trading spiked.

In an ethics filing he electronically signed in June, Blanche said his bitcoin and other cryptocurrency investments — including Solana, Cardano and Ethereum — “were gifted in their entirety to my grandchild and adult children.” Financial disclosure records don’t provide exact amounts but instead a broad range for the worth of a government official’s investment. At that point, Blanche’s records show his transfers to his family members were worth between $116,000 and $315,000. He said he sold additional crypto-related investments worth between $5,000 and $75,000. The divestment took place in late May and early June, the ethics filing said.