The Rise Of Crypto Treasury Strategies

A New Era for Crypto Treasury Strategies

More and more companies are now raising cash specifically to implement crypto treasury strategies—allocating funds to buy bitcoin and other cryptocurrencies. MicroStrategy pioneered this approach at scale, and its success has inspired a wave of corporate imitators worldwide.

MicroStrategy’s Bold Bet on Bitcoin

MicroStrategy began buying bitcoin in August 2020. As of July 18, 2025, it holds about 601,550 bitcoins, valued at over $70 billion at current prices. The company paid an average of $71,268 per coin, totaling $42.87 billion in investment.

With bitcoin trading near $120,000, MicroStrategy’s bitcoin position has gained approximately 68%.

Its stock has done even better. Since January 2025, shares are up 46%, beating bitcoin’s 26% gain over the same period. Since launching its bitcoin strategy in 2020, MicroStrategy stock has surged over 3,000%.

The Copycat Effect in Crypto Treasury Strategies

MicroStrategy’s performance has turned heads. Japan’s Metaplanet is one standout follower. The company says holding bitcoin through its stock offers tax advantages under Japanese law. Since April 2024, Metaplanet has accumulated over 16,000 bitcoin, and its stock price has jumped over 4,000%.

“One of the strategic advantages… is the more favorable tax treatment of shareholders who seek exposure to bitcoin through its stock versus the punitive tax treatment of those who own bitcoin directly.”

– Benchmark Equity Research, 11 July 2025

Not all imitators have fared as well. GameStop entered the market in May 2025 following board approval in March. After raising $2.25 billion, likely for bitcoin purchases, its stock has remained volatile. So far, companies that moved early and stayed focused have delivered the strongest returns.

Ethereum Enters the Crypto Treasury Spotlight

While bitcoin led the way, Ethereum is now gaining ground in corporate treasuries.

In June 2025, SharpLink Gaming (SBET) raised $425 million in a deal led by Consensys and named Ethereum co-founder Joseph Lubin as chairman. The company said it would use nearly all the cash to buy ether, Ethereum’s native token. SBET shares jumped from $3 to nearly $79, and by July 18, traded at $29—still nearly 900% higher than before the announcement.

Another example is BitMine Immersion Technologies. In May, crypto bull Tom Lee joined the board, and Peter Thiel acquired a 9.1% stake. BitMine revealed that about 40–50% of its treasury is now in ether. The stock soared from $3 to $135, and by July 18, closed at $42.35—a 1,300% gain from pre-announcement levels.

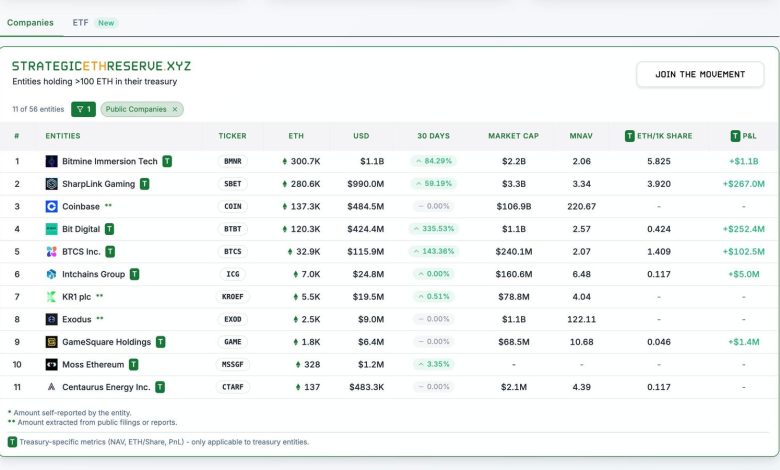

A list of Ethereum treasury companies:

A list of Ethereum treasury companies

Beyond Bitcoin: Expanding Crypto Treasury Strategies

The trend is expanding beyond BTC and ETH. SRM Entertainment, now Tron Inc., has gone all-in on TRX. Others have adopted BNB, Hyperliquid, and even Litecoin as reserve assets.

In one dramatic case, YHC Corporation became a media sensation after Robert Leshner (founder of Compound) announced plans to acquire it and turn it into a crypto treasury company—then backed out due to lawsuits over the control issues. The stock whiplashed, highlighting how speculative this sector has become.

With so many companies jumping into crypto, skepticism is growing.

“We’re seeing companies with no real crypto ties suddenly pivot to these strategies just to pump their stock. It feels like a bubble.”

– Anonymous fund manager, Bloomberg Markets, July 2025

Risks Facing Crypto Treasury Strategies

Despite big returns, the risks are real.

Critics argue that many crypto treasury strategies depend on a fragile loop: raise money, buy crypto, drive up share price, then raise more.

Prominent short-seller Jim Chanos has been one of the harshest voices. He warns that MicroStrategy trades well above the value of its bitcoin holdings—and that its complex financing structure adds risk.

“MicroStrategy’s model is simple: borrow cheap, buy bitcoin, watch it rise, sell more stock at a premium, and repeat,” he said. “But if bitcoin falls or debt costs rise, the whole cycle could break.”

He compares the current trend to the SPAC bubble of 2021—where hype fueled overvalued companies that eventually collapsed.

Peter Schiff, Chief Economist & Global Strategist at Europac.

Conclusion: The Future of Crypto Treasury Strategies

Crypto treasury strategies are changing how companies manage their cash. Early adopters have seen massive gains, but risks around volatility, debt, and euphoria are growing. Whether this marks a true financial revolution or just another speculative bubble remains to be seen—but for now, crypto treasury strategies are clearly rewriting the corporate playbook.