Keep it Moving! 10 Exciting Ways to Stay Active During Retirement

Y’all have heard the popular saying “Black don’t crack.” when it comes to external signs of aging with our people. But are you aware of any commonly held beliefs in the community about aging well from the inside out during retirement? Some of us live day to day, often paycheck to paycheck, fighting age-accompanying illnesses of disabling diseases like diabetes, hypertension, heart trouble, glaucoma, and losses of various types. We push through; we ignore symptoms because nobody has time for that [like going to the doctor to get checked out or dealing with being sick, as if busyness would excuse us from illness]. But even with the necessary means, we fail to create real wealth, leave long-term legacies, or sufficiently invest in ourselves, body, mind, heart and soul, for more time to spend with our loved ones. There may come a time when we either choose to stop hustling or have to stop due to illness if we have not prepared.

Retirement can seem like a far-off fairy tale that we may not get to experience or know of few people who have. But what if you make it to retirement age and your financial planning pays off? Will you be well enough to enjoy it? The best way to plan for a future with a health span the same length as your life span is to keep it moving once you’ve retired.

Many of us want to retire and if we are among those who are blessed financially and physically able to retire after decades of working and planning for it, we have no idea what it could look like for us. Here are ten exciting ways to keep it moving, stay active during retirement, and help you create a positive picture of possibilities for life in your golden years.

Keep your mind active

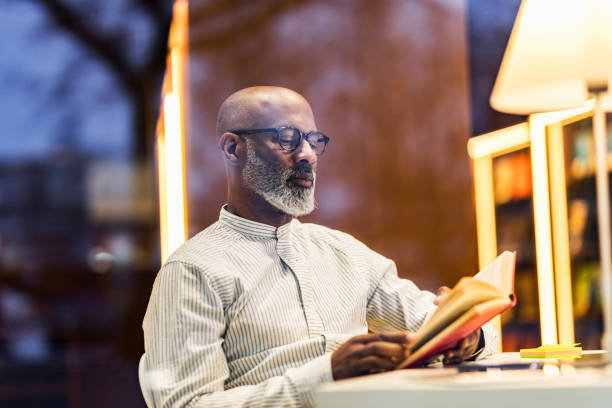

1. Read

Try to continue to keep your mind active by reading. If reading for the sake of reading is not your thing, then think about joining a group of sisters or brothers for a book club: part reading and part socializing. Find one at your local public library, bookstore, Eventbrite, or even Facebook for a virtual group meeting. If none of these suits your fancy and you’re still not satisfied, go on and start your own.

2. Learn

Volunteer to help someone else or participate in an activity where you have to learn something new. Think of activities like driving a Meals-on-Wheels route and learning the way to and the ways of those you are delivering to or joining a choir and learning new music. Teach or tutor something you are an expert in. Or learn a new hobby like bridge, get a new spades partner, learn chess, take a cooking class, or learn a new language.

Keep your mind active and moving by learning what’s new in your area of expertise. The local senior center or community center, community college continuing education programs, gym, United Way, or, best of all, word of mouth from your sistas, homeboys, neighbors, or similarly situated and interested former colleagues or faith friends can also help guide you where you want to go.

3. Serve

Ask those you know who are in the know for ideas and opportunities to give back by volunteering, mentoring, or maybe even a part-time gig. Your perspective would be one of coming to “work with ya’, not for ya’” as a key distinction. For pay or pro bono, a part-time paid or strictly volunteer role may be the perfect niche for you to fill on your terms—you can afford to be choosy; the experience you had while working could mean a new chapter for you after you’ve stopped.

Former teachers are in demand to substitute teach. The Service Corps of Retired Executives (SCORE) offers business advice and mentorship to people in small businesses. And the possible opportunities only end with your creativity. Negotiate your time because your experience is the most invaluable asset you bring to the table.

RELATED: The Basics of Planning for Your Retirement

Keep your body functioning

1. Exercise

Keep it moving and keep it fun: walk, run, swim, hike, do yoga, skate, play basketball, golf, tennis, dance, or partaking in